Vendor Payment Transmission Failed Due to Connection Issues. Please Try Again Later

Problem

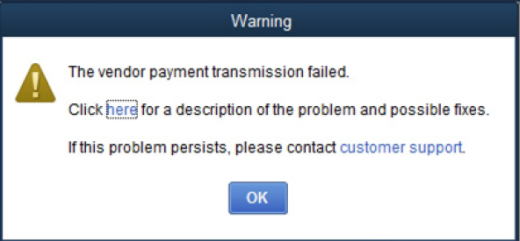

When sending direct deposit for independent contractors y'all receive the post-obit error:

The vendor payment transmission failed.

Click here for a description of the problem and possible fixes.

If this problem persists, please contact customer back up.

When the "here" link above is clicked the Intuit Payroll Service Account Information screen volition open up. These additional error messages will appear:

Ane or more direct deposit vendor payments failed.

There was at to the lowest degree one payment to a non-1099 vendor in the directly deposit vendor payments you sent on XX/20/XXXX at ##:##. Unfortunately, we can't procedure straight deposit payments to vendors who are not independent contractors (1099 vendors), so all the vendor payments in the transmission failed.

You will need to remove the payments y'all've made to non-1099 vendors (by changing the payment method to printed check or, if appropriate, mark the contractor as a 1099 vendor) and resend the payments you're making to 1099 vendors. Click hither for more detailed instructions for correcting and resending the payment transactions, equally well as alternatives for making electronic payments to non-1099 vendors.

Only 1099 vendors tin can be paid with this service. Remove the non-1099 vendor payments and resend the payment transaction. For boosted explanation, instructions, and options run across payroll.com/DD4V.

Crusade

This problem is caused because one or more of your independent contractors is not marked equally a 1099 vendor.

Solution

In order for Intuit to meet Federal and State compliance requirements on a consistent basis beyond all of our offerings, the Intuit Straight Deposit service cannot be used to pay bills or make payments to individuals or entities who are not independent contractors.

What is an contained contractor? Utilise the resources to determine if individual providing services is a employee or independent contractor:

- IRS.gov: Independent Contractor Divers

- IRS.gov: Contained Contractor (Self-Employed) or Employee?

- Intuit Guide to Hiring: Classify Workers Correctly: Independent Contractors vs. Employees

To resolve this error:

-

Determine how many and which vendor direct deposit checks you are sending.

Click E mployees > Send Payroll Data and reviewing the Items to Send window. Click Banking > Use Annals to review each directly deposit entry to decide who the payments are for.

-

Determine which vendors are not marked every bit 1099:

You can check each Vendor individual or create the report below.

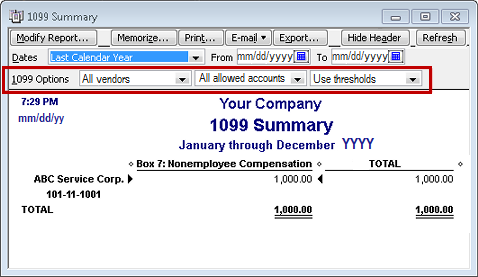

- In QuickBooks, go to Reports > Vendors and Payables > 1099 Summary.

- In the 1099 Options, click the first dropdown push button and select Only 1099 vendors. Review the written report and see if the amounts are missing.

- In the 1099 Options, click the first dropdown button once again and select All vendors. If the report shows the missing amounts already, and so the vendors for the missing amounts are not marked equally Eligible for 1099.

- In QuickBooks, go to Reports > Vendors and Payables > 1099 Summary.

If your vendor is non an Independent Contractor:

You must alter the direct eolith payment to a regular check. Locate the check from the register, double-click to open and remove the checkmark next to Online Payment and so click Save & Close.

If your vendors are Independent Contractors: Turn on 1099-MISC and mark your vendors eligible for 1099s:

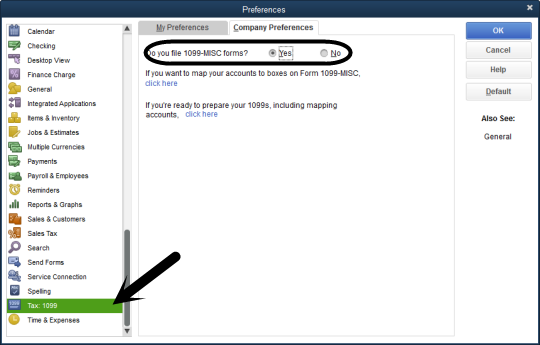

- Open up QuickBooks.

- Click Tax: 1099 on the left.

- Click the Visitor Preference tab.

- Adjacent to Exercise y'all file 1099-MISC forms? select Yes.

- Click OK to save the preference.

- Cull Vendors > Vendor Eye.

- Right click on a vendor's name and then click Edit.

- Click the Address Info tab and validate the data.

- Make sure the Accost field contains the appropriate two-letter state abbreviation and the correct ZIP code.

- If the vendor is a person, the vendor's legal name should appear in the Outset Name, M.I., and Last Proper noun fields.

- If you know the visitor name but not the person's name, leave the Company Proper noun field bare to prevent double names from appearing on the 1099-MISC form.

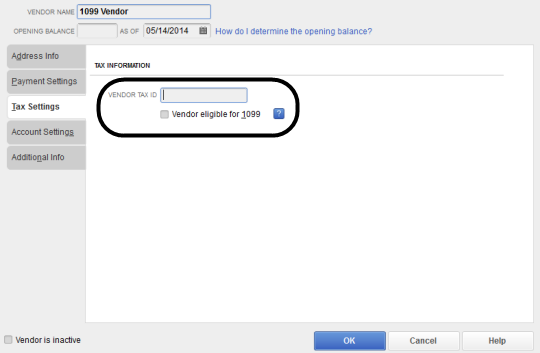

- Select the Tax Settings tab.

- Checkmark the Vendor eligible for 1099.

- Enter the vendor's tax identification number in the Vendor Tax ID field. Click OK to salvage your changes.

- Repeat steps 6 through xi for each 1099-eligible vendor.

- Once you accept completed making changes to your vendors and/or payments in QuickBooks, resend your payments to Intuit. Click Employees > Ship Payroll Data and click Send All.

Preventing Future Failed Transmissions:

For non-1099 vendors, the user volition need to remove the directly deposit information from the vendor tape to prevent inadvertently creating an incorrect direct deposit payment in the future.

To practice this:

- From the Vendors bill of fare, click Vendor Center.

- From the list on the left, double-click the 1099 vendor you want to remove from directly deposit.

- On the Additional Information tab, click Direct Deposit.

- In the Direct Deposit window, clear the Use Straight Deposit for checkbox.

Related Articles

Paying independent contractors using Direct Deposit

Gear up a vendor and print 1099/1096 forms

Sign upwardly and set up Directly Deposit for Contained Contractors

Source: https://quickbooks.intuit.com/learn-support/en-us/help-article/bank-deposits/error-vendor-payment-transmission-failed/L7vKhapvw_US_en_US

0 Response to "Vendor Payment Transmission Failed Due to Connection Issues. Please Try Again Later"

Post a Comment